A long hard look into the steel behemoths and what they are saying about the health of the oil market

Tankers are undoubtedly one of the stories of 2024 when it comes to unmet expectations. No one was hoping for the 2022 bumper year to repeat but at least to maintain last year’s elevated levels and try to stretch the supercycle for a little longer, before the inevitable “reversion to the mean” shows its ugly head. The factors that propelled the tanker boom in the last two years are gradually receding, combined with fundamentals in the oil market weakening by the day proved to be a blow into winter peak season high hopes.

Let’s start from the top and take a look where the industry stands.

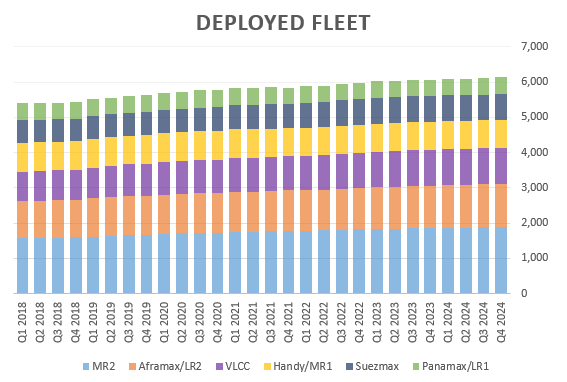

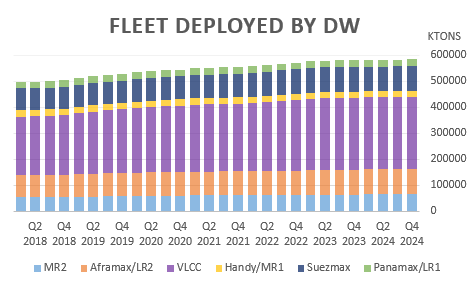

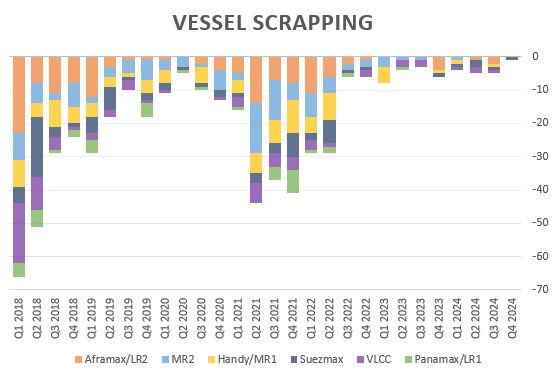

Taking 2019 as a basis, total tanker fleet grew relentlessly not only in number of ships but in total deadweight, approximately 15%, while seaborne trade grew at a mere 7% over the same period, when accounted for volumes shipped normalizing 2020 and 2022 peaks and valleys. Back in 2018/19 the tanker market was suffering from a chronic oversupply of tonnage, and before COVID, Russia and the Houthis the market was self-healing by good old natural selection, in shipping that means sending ships to recycling to a beach in Pakistan.

That chance for the market to self-regulate ground to a halt when sanctions against COSCO in 2019 removed a good chunk of VLCCs from the main trade, deflecting the older vessels to enter the Iranian dark fleet, vessels that otherwise would be sent to scrap (sounds familiar?). Next year, 2021 was the worst I can remember for tankers so scrapping resumed but at a much slower pace and then Russia sanctions picked up all the scrappy vessels that were around.

Although we can say we have a two-tiered market, 6mn barrels of crude oil per day out of the 40Mn loaded daily on tankers, are operating unrestrained, with different economics and set of rules, those at the end of the day are a unit of supply, no matter what kind of barrel it serves, and that’s a problem the tanker industry is still carrying from 2021, the structural oversupply is still there but disguised as inefficiency.

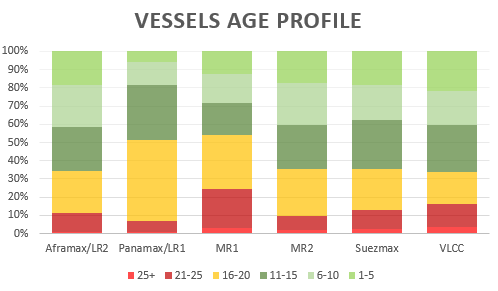

We can clearly see that through the age profile of the fleet, on average 15% of the fleet are firm candidates to exit the market and this gives me some optimism in the near term, let’s say Trump removes sanctions on Russia, or removes the price cap allowing the mainstream shipowners to return to the trade, much of that fleet will be sent to recycling, resuming the trend aborted in 2022… not without a caveat… you see, most of the vessels purchased by Russian interest didn’t make their money back, those Afras at $40/50 M made on average $80k a day with an appalling utilization rate (30%). I don’t know if Rosfnet would be fond to let them go just like that.

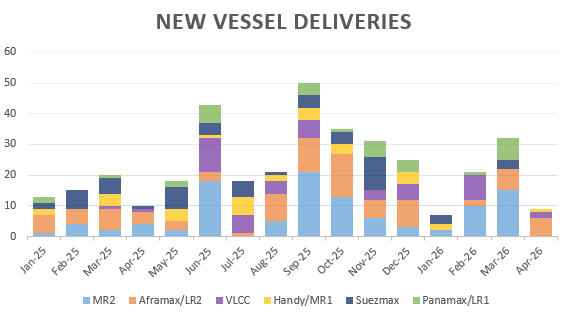

Now, on the flipside, shipowners found themselves with some pocket money and couldn’t resist the temptation to order new ships, but thanks to the shipyard capacity being busy building containers and LNG carriers, the bulk of the new tankers are coming in late 26/27. Those would be interesting times, by then active fleet size should be more balanced.

One other dynamic that is currently playing out, is that shipowners are no longer afraid of ordering ships in China, and China needs money... that could tilt the balance once again.

Anyway, why tankers are doing so poorly?

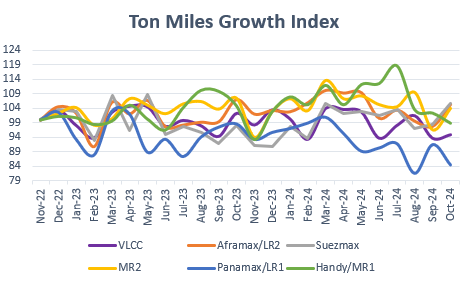

Looking at ton miles, things doesn’t look that different from prior years, with some exceptions of Panamax/LR1 that are doing more shuttle trades in the Americas.

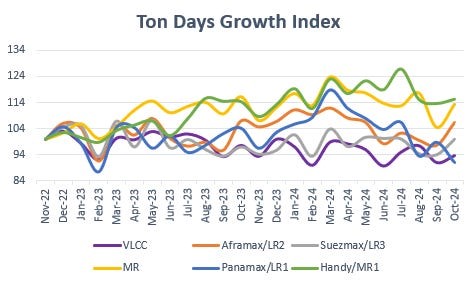

But in ton days the picture is different, and that is China, not only because it is buying less oil, it is buying less of everything, and that removes the infamous Chinese port congestion that ties up vessels for weeks, that’s not there today and you can clearly see that on VLCCs.

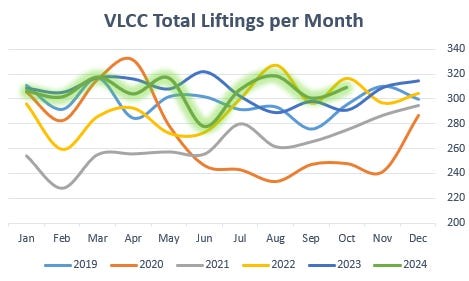

Total number of liftings is on par with previous years, with some faring better than others.

Suezmax benefitted from trading clean cargoes in the last two months, which kept them busy on the Middle East.

Afras has been hit the hardest, Libya, poor WTI arbitrage economics and Europe slowdown.

On vessel utilization (loaded vessels as a % of total fleet) is not far from last year, albeit much more volatile. A couple of points might not seem much, but freight rates are quite sensitive to this metric.

Sailing distances

Sailing distances are a touch lower than a year ago, with some bright spots for the smaller vessels (clean cargo trading).

What I think sent this market tumbling in the recent weeks is a change in mood from market participants once the realization of China not being active by this time of the year, plus oil markets trending down and dragging sentiment with it.

FFAs till not long ago were pricing winter demand for tankers to be one standard deviation higher than it was trading spot, ultimately the spread between M1/M3 collapsed and the curve is trading flat.

All vessel classes moved in tandem which suggests this is not entirely fundamentally driven.

There is some degree of truth that some expectations were overblown and it took a couple of failing fixtures to bring everything crashing down.

Conclusion

So, what killed the market this year? Think of tankers as oil traders, tankers thrive on volatility and market inefficiencies, and what we didn’t have this year were those.

In fact, oil traders didn’t have a good year either, lack of volatility means less arbitrage opportunities, limited risk-taking and ultimately results in less flows.

Hopefully, next year will see some volatility returning to the oil markets that could dampen the current sentiment.

Events that could reshape the supply/demand picture:

- Assuming all Iranian barrels are removed from the market, that would equate to an additional 33 VLCCs requirement to serve that trade (3% of the fleet).

- Russian sanctions lifting, that might take some time to permeate, but Aframaxes and Suezmaxes should be the first recipients of improved demand, depending on how much those markets would stretch VLCCs should follow through.

Oil Market Analysis

We deliver real-time assessments of crude oil fundamentals, pricing dynamics, and the interplay between regional and global markets. We provide industry insights and our ability to distill complex data into clear, concise analysis, helps you to optimize your trading and commercial strategies in today’s fast-paced environment.